Malaysias taxes are assessed on a current year basis and are under the self-assessment system for all taxpayers. The tax rate is reduced to 17 from 18 for.

Pros And Cons For The U S Of Flat Vs Progressive Taxes Toughnickel

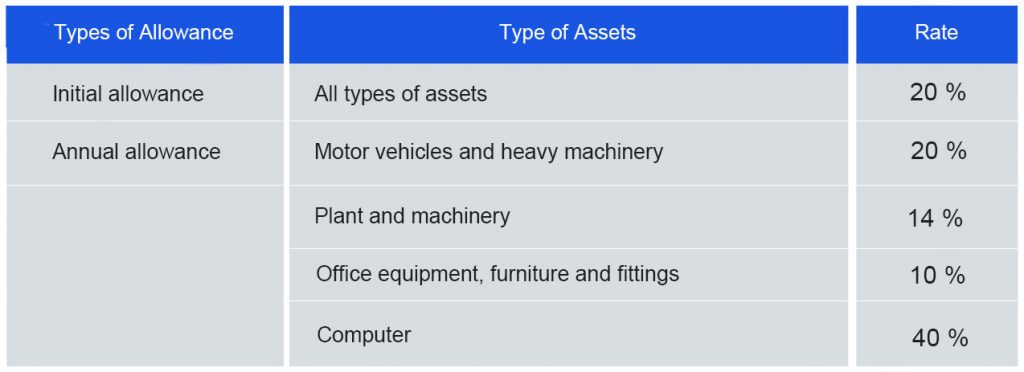

There are different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions.

. After introducing Malaysian e visa the number of tourist visiting the. Corporate income tax in Malaysia is applicable to both resident and non-resident companies. Malaysia is one of the countries who implements territorial tax system - basically any income accrued in or derived within Malaysia is liable to tax.

Independent contractors and full-time employees share some basic similarities in terms of what types of. Type of indirect tax. Types of Tax Liable by Companies Registered in Malaysia Sales Service Tax SST.

Malaysias tax system is no different. It should be highlighted that based on the LHDNs. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia.

Taxable income band MYR. For non-residents in Malaysia the income tax rate ranges from 10 28 for YA 2019. As a full-time employee.

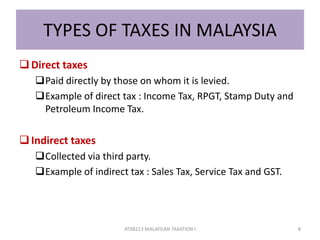

Direct tax includes income tax real property gains tax RPGT and petroleum income tax whilst indirect. Tax Credit Set Off. Property Stamp Duty Memorandum of.

For non-residents in Malaysia the income. Individual and the husband wife who elects for joint. Taxes on income are generally not deductible whereas indirect taxes are deductible.

Paying taxes as an independent contractor vs. Taxable income band MYR. There are 5 different property taxes in Malaysia.

There are 5 different property taxes in Malaysia. Heres an overview of the type of tax liable. Excise duty is a type of tax.

In other words resident and non-resident organisations. Vacation time paid for by your employer in two categories. Sales Tax and Service Tax were implemented in Malaysia on 1 September 2018 replacing Goods and Services Tax GST.

Cukai taksiran is a much more familiar term for this type of tax. There are two major taxes in Malaysia namely direct tax or indirect tax. Contract payments 10 3 Royalties 10 Interest payments.

The goods and services tax in Malaysia has two rates 6 and 0. Value added taxes excise charges quit rent Goods and Services Tax Service Tax and Sales Tax and other indirect taxes are examples. Basically homeowners will now just pay the tax for their own parcel their own unit.

Taxable income band MYR. 26 Taxable income band MYR. In Malaysia corporations are subject to corporate income tax real property gains tax goods and services tax GST and etc taxes.

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Current Tax Types In Turkey Download Scientific Diagram

Why It Matters In Paying Taxes Doing Business World Bank Group

Why It Matters In Paying Taxes Doing Business World Bank Group

A Malaysian S Last Minute Guide To Filing Your Taxes

Impacts Of The Self Assessment System For Corporate Taxpayers

How Does The Current System Of International Taxation Work Tax Policy Center

Understanding Tax Smeinfo Portal

The Tax System In Malaysia Guide Expat Com

Who Are Winners And Losers Of Sst

Customer Tax Ids Stripe Documentation

Types Of Taxes In Malaysia For Companies

Tax Planning Back To Basics The Edge Markets

Individual Income Tax In Malaysia For Expatriates

Current Tax Types In Turkey Download Scientific Diagram

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download